The Process of Issuing Bonds

A bond is a loan from the public, also referred to as Certificates of Obligation. When corporations or government bodies need to raise money, they may sell bonds to the public. a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest (the coupon) and/or to repay the principal at a later date, termed maturity. By issuing bonds an entity, such as a business, is selling debt on the open market.

Bonds and stocks are both securities, but the major difference between the two is that stock-holders have equity in the company and bond holders are lenders to the company. Also, most bonds have a defined term to maturity.

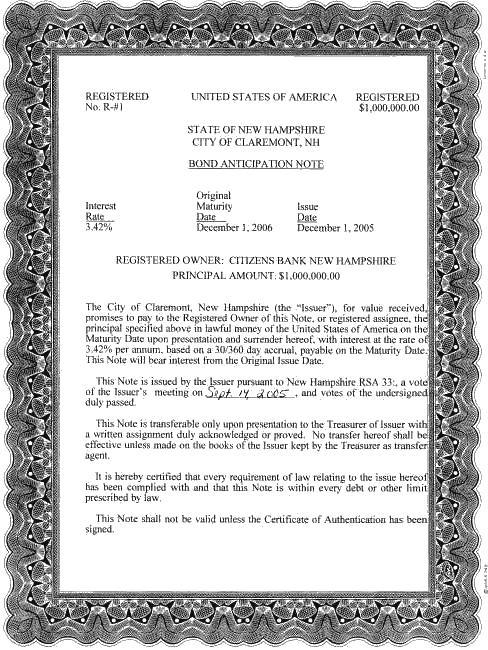

The anatomy of a bond is made up of a) the face amount, b) issue price, c) maturity date, and d) coupon (interest rate). Fixed rate bonds have a coupon that remains constant throughout the life of the bond.

Call options allow the company or entity issuing the bond to cash out the bonds before they reach their maturity dates. Convertible bonds allow the bond holder to convert the interest into company stock.

Who Issues Bonds

Private companies and companies that have made an initial public offering (IPO) may issue bonds. Local, state, and federal government bodies may also issue bonds. For government entities bonds are the only way to raise capital other than levying taxes.

An Underwriting Firm agrees to purchase bonds from the issuing company. The underwriting firm then sells the bonds to investors. The underwriting firm receives a fee from the company.

Municipal bonds issued by state and local governments are also brought to market by underwriters.

Junk Bonds

High Yield Bonds are sometimes referred to as Junk Bonds because they involve high risk. Because the investment is more risky, these high yield bonds tend to pay at a higher rate of interest.

Lenders of Last Resort

In the commercial world companies consider banks a lender of last resort. There are many advantages to selling debt to the public as an alternative to borrowing money from a bank.

Bond Note Example